Compare Car Insurance Rates

Compare Car Insurance Rates

Instantly compare car insurance quotes to find the cheapest rate.

Why comparing auto insurance quotes is important

You’re looking to save money on car insurance, and you know you have to comparison shop to find the best deal.

However,

many auto insurance quote comparison websites can’t sell you insurance.

Instead, they make money by selling your personal information to

insurance companies and brokers.

How to compare car insurance quotes

You need an auto insurance policy that covers your needs (without going overboard) and doesn’t cost an arm and a leg. Take these steps to make sure you’re getting the best deal:

- Year

- Make

- Model

- Special features

- Safety features

Liability: Covers the other drivers on the road and meets most state’s legal requirements, but won’t protect you if you’re involved in an accident.

Collision: Provides protection against road accidents. If you’re involved in an accident, your insurer will cover all or part of the cost of repairing or replacing your vehicle, depending on your coverage limits.

Comprehensive: Protects you against practically everything else that can happen to your car. That includes damage from natural disasters, vandalism, and theft.

Full coverage is great to have, especially for drivers who frequently park on busy streets, but not everyone needs it. If your car is an older model, typically parked in a garage, or not driven heavily, you may save money by cutting down on insurance.

Comparing auto insurance rates can save you money

We can then look for a better rate—with equal or better

coverage—from other insurance companies. Within a few minutes, we’ll let

you know if you’ve got the best deal, or if you can save money by

switching.

Unlike some car insurance comparison tools, we also

offer renters and home insurance quote comparisons. Using these, you can

determine whether you’ll save money by bundling your auto and home

insurance, or if you can save the most by using two companies.

Can you save money by switching?

Many

people are overpaying for their insurance and don’t realize it because

they haven’t looked for a better deal. You can keep your same car,

driving habits, record, and coverage, and still save money simply by

switching insurance providers.

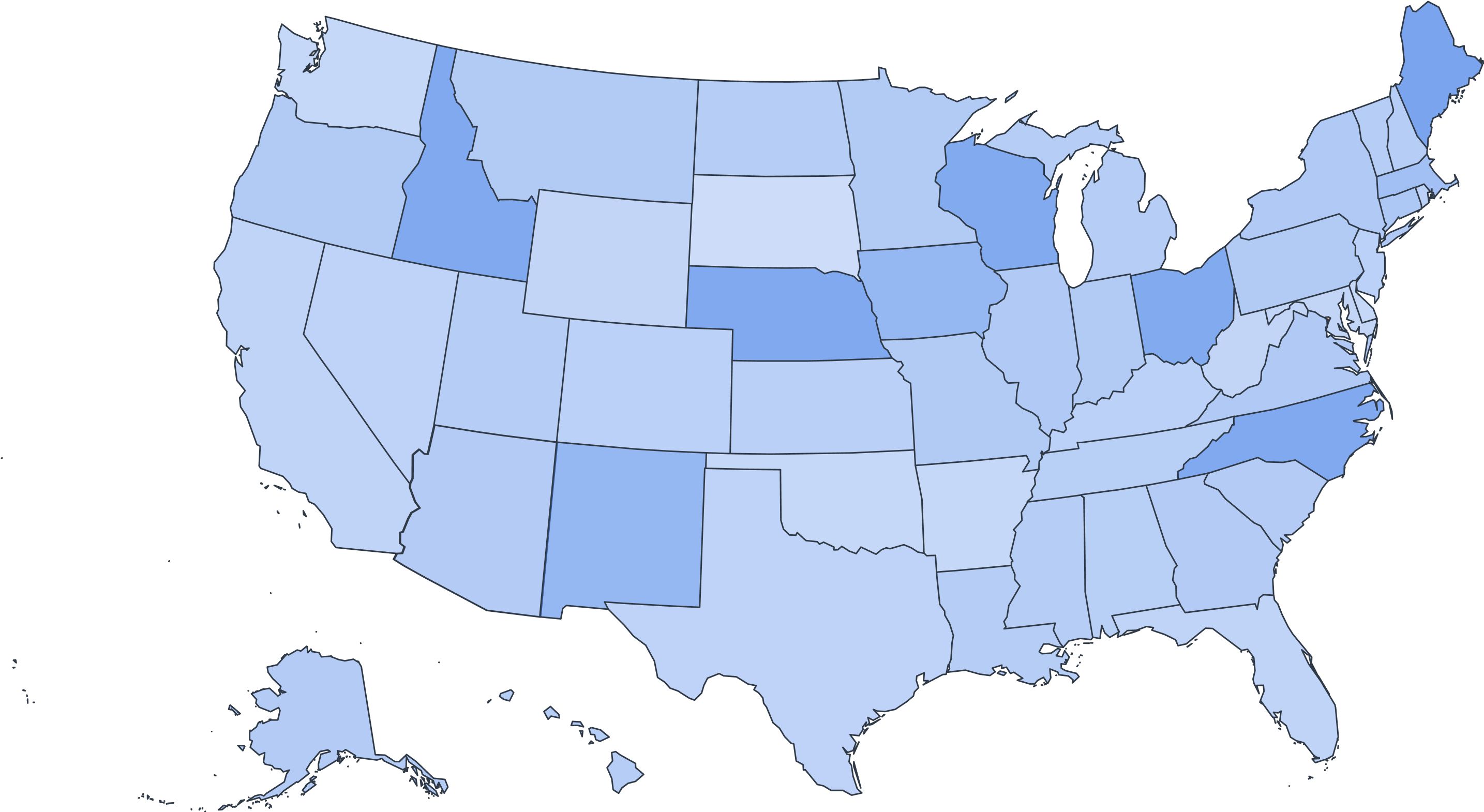

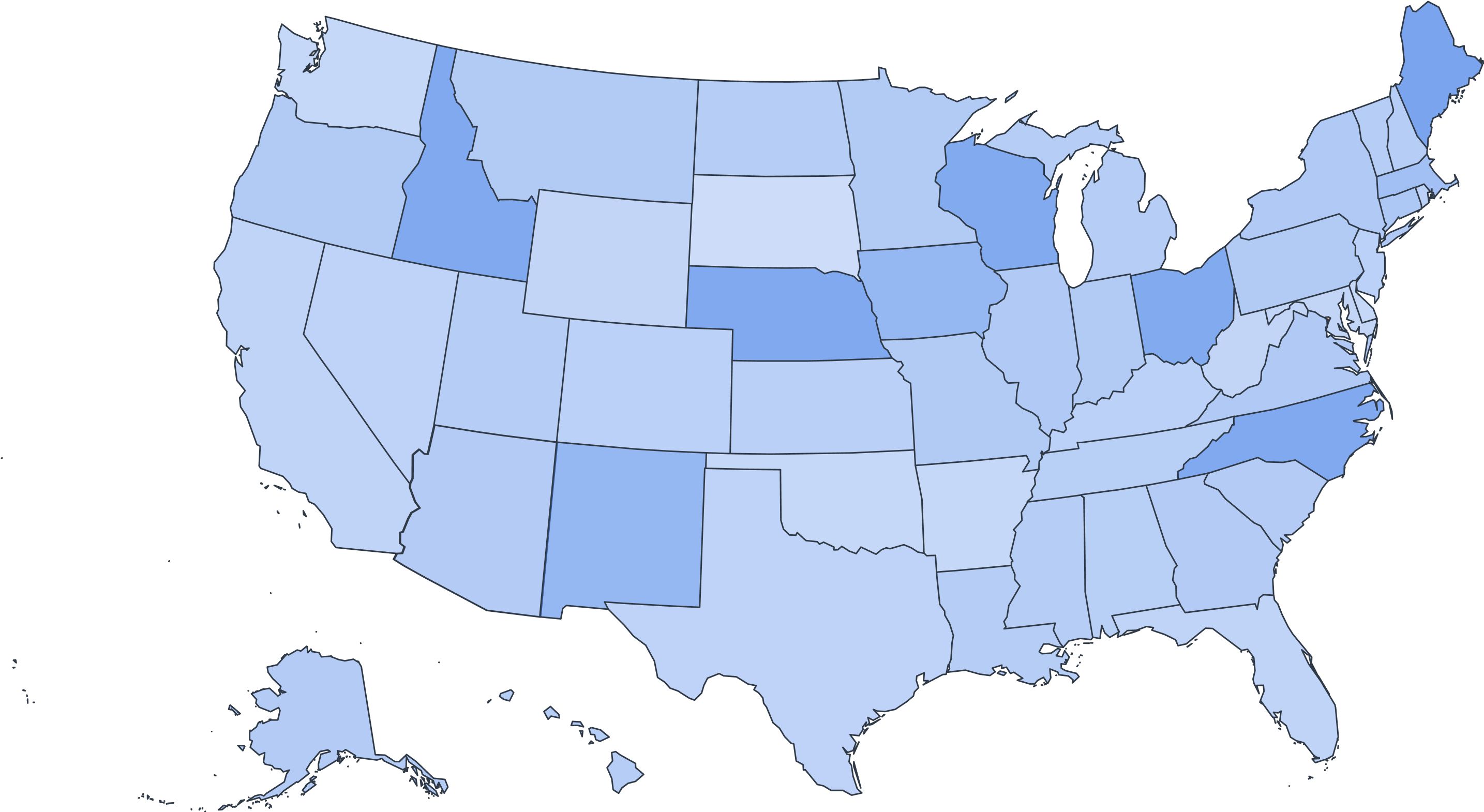

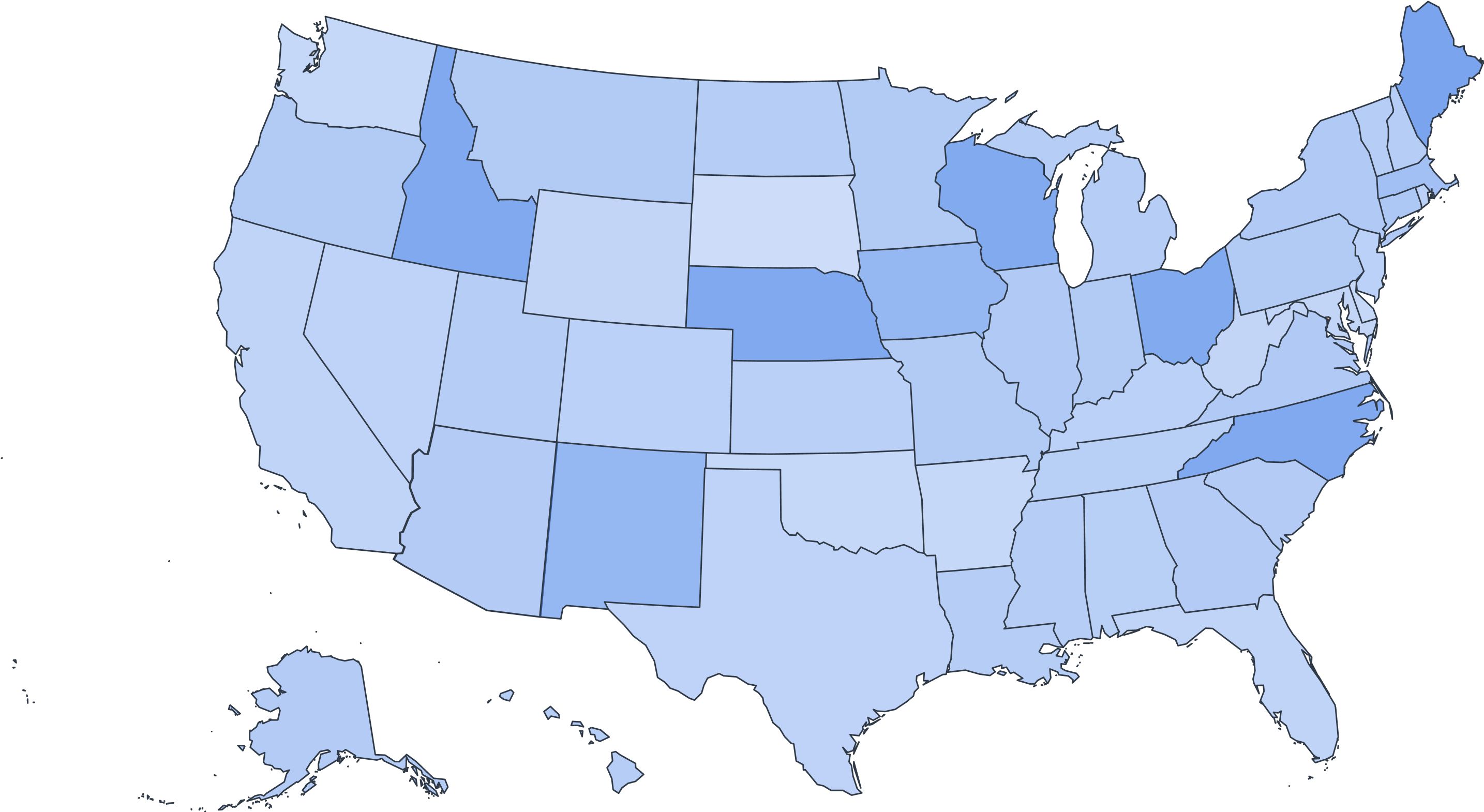

Average Monthly Car Insurance Overpayment By State

What impacts your car insurance rates?

The insurance provider you choose is important, however these are the factors that affect your car insurance rates.

Car Insurance Comparison by Age and Gender

Your age can be a major factor in how much you pay, as young drivers tend to be riskier drivers. Gender can play a role as well, although it’s not as important of a factor.

Auto Insurance Rates by Age

Average Auto Insurance Rates for People Under 20

| Company | Average Annual Premium |

|---|---|

| Allstate | $1,780 |

| Clearcover | $2,890 |

| Mercury | $2,498 |

| MetLife | $2,351 |

| National General | $2,505 |

| Progressive | $2,877 |

| Safeco | $2,453 |

| Travelers | $2,298 |

Average Auto Insurance Rates for Those in Their 20’s

| Company | Average Annual Premium |

|---|---|

| Allstate | $1,943 |

| Bristol West | $2,514 |

| Clearcover | $1,877 |

| Mercury | $2,159 |

| MetLife | $1,692 |

| National General | $1,979 |

| Nationwide | $1,754 |

| Progressive | $1,891 |

| Safeco | $1,976 |

| Travelers | $2,230 |

Average Auto Insurance Rates for Those in Their 30’s

| Company | Average Annual Premium |

|---|---|

| Allstate | $2,084 |

| Bristol West | $2,318 |

| Clearcover | $1,740 |

| Mercury | $2,173 |

| MetLife | $1,663 |

| National General | $1,960 |

| Nationwide | $1,867 |

| Progressive | $1,693 |

| Safeco | $1,935 |

| Travelers | $1,958 |

Average Auto Insurance Rates for Those in Their 40’s

| Company | Average Annual Premium |

|---|---|

| Allstate | $2,495 |

| Bristol West | $2,597 |

| Clearcover | $2,049 |

| Mercury | $2,309 |

| MetLife | $1,909 |

| National General | $2,112 |

| Nationwide | $2,211 |

| Progressive | $2,058 |

| Safeco | $2,038 |

| Travelers | $2,300 |

Average Auto Insurance Rates for Those in Their 50’s

| Company | Average Annual Premium |

|---|---|

| Allstate | $2,581 |

| Bristol West | $2,023 |

| Clearcover | $1,901 |

| Mercury | $1,663 |

| MetLife | $2,218 |

| National General | $1,862 |

| Nationwide | $2,179 |

| Progressive | $2,041 |

| Safeco | $1,960 |

| Travelers | $2,429 |

Average Auto Insurance Rates for Those in Their 60’s

| Company | Average Annual Premium |

|---|---|

| Allstate | $2,347 |

| Bristol West | $2,089 |

| Clearcover | $1,665 |

| Mercury | $1,456 |

| MetLife | $1,590 |

| National General | $1,790 |

| Nationwide | $1,727 |

| Progressive | $1,563 |

| Safeco | $1,487 |

| Travelers | $1,973 |

Average Auto Insurance Rates for Those Over 70+

| Company | Average Annual Premium |

|---|---|

| Allstate | $2,198 |

| Bristol West | $2,940 |

| Clearcover | $1,588 |

| Mercury | $1,708 |

| MetLife | $1,720 |

| National General | $2,265 |

| Nationwide | $1,726 |

| Progressive | $1,428 |

| Safeco | $1,551 |

| Travelers | $1,827 |

Compare Auto Insurance Rates By Driving History

Your driving record is also important. The more recent accidents or traffic violations you’ve had, the more you’ll wind up paying.

Average Annual Premium

| Number of Incidents | Average Annual Premium |

|---|---|

| 0 | $1,416 |

| 1 | $1,604 |

| 2 | $1,883 |

| 3 | $2,126 |

| 4 | $2,337 |

| 5 | $2,493 |

| 6 | $2,711 |

| 7 | $2,985 |

| 8 | $3,061 |

| 9 | $3,158 |

| 10 | $3,174 |

| 11 | $3,208 |

| 12 | $3,666 |

Auto Insurance Premiums by Coverage Type

Your coverage limits, types, and deductibles will directly impact your premiums. You’ll have to decide whether you prefer more coverage and lower deductibles, or a lower cost.

Average Car Insurance Premiums by State Full vs Non Full Coverage

| State | Average Annual Premium (Non Full Coverage) | Average Annual Premium (Full Coverage) |

|---|---|---|

| Alabama | $916 | $1,939 |

| Alaska | NA | NA |

| Arizona | $953 | $1,901 |

| Arkansas | $1,175 | $1,922 |

| California | $964 | $2,249 |

| Colorado | $1,022 | $2,193 |

| Connecticut | $1,764 | $2,225 |

| Delaware | $3,611 | $2,282 |

| District of Columbia | $1,087 | $2,020 |

| Florida | $1,508 | $2,568 |

| Georgia | $1,628 | $2,688 |

| Hawaii | $547 | $682 |

| Idaho | $761 | $1,178 |

| Illinois | $803 | $1,517 |

| Indiana | $845 | $1,563 |

| Iowa | $732 | $1,479 |

| Kansas | $753 | $1,989 |

| Kentucky | $1,407 | $2,288 |

| Louisiana | $1,688 | $2,971 |

| Maine | $697 | $1,147 |

| Maryland | $1,768 | $2,556 |

| Massachusetts | $1,625 | $1,829 |

| Michigan | $1,779 | $2,704 |

| Minnesota | $1,101 | $1,578 |

| Mississippi | $944 | $2,050 |

| Missouri | $1,263 | $1,929 |

| Montana | $746 | $1,749 |

| Nebraska | $920 | $1,672 |

| Nevada | $1,271 | $2,297 |

| New Hampshire | $933 | $1,249 |

| New Jersey | $1,675 | $2,470 |

| New Mexico | $858 | $1,747 |

| New York | $2,157 | $2,607 |

| North Carolina | $989 | $1,534 |

| North Dakota | $1,180 | $1,978 |

| Ohio | $789 | $1,450 |

| Oklahoma | $859 | $1,827 |

| Oregon | $1,187 | $1,784 |

| Pennsylvania | $1,066 | $1,812 |

| Rhode Island | $1,872 | $2,589 |

| South Carolina | $1,611 | $2,191 |

| South Dakota | $810 | $1,612 |

| Tennessee | $832 | $1,833 |

| Texas | $1,134 | $2,244 |

| Utah | $1,329 | $1,741 |

| Vermont | $694 | $1,331 |

| Virginia | $1,043 | $1,681 |

| Washington | $1,178 | $1,994 |

| West Virginia | $856 | $1,912 |

| Wisconsin | $737 | $1,418 |

| Wyoming | $735 | $1,521 |

Average Car Insurance Premiums by Insurance Company Full vs Non Full Coverage

| Carrier Name | Average Annual Premium (Non Full Coverage) | Average Annual Premium (Full Coverage) |

|---|---|---|

| Allstate | $1,123 | $2,341 |

| Bristol West | $1,444 | $3,040 |

| Clearcover | $1,099 | $1,985 |

| Mercury | $1,138 | $2,296 |

| MetLife | $712 | $1,890 |

| National General | $1,216 | $2,413 |

| Nationwide | $1,086 | $2,061 |

| Progressive | $1,396 | $2,198 |

| Safeco | $1,153 | $2,062 |

| Travelers | $1,396 | $2,198 |

Remember,

full coverage insurance includes the three main types of car insurance:

liability, collision, and comprehensive. The liability portion covers

other drivers (and their property) in the event of an accident. The

collision coverage protects you and your property in an accident.

Comprehensive coverage protects your vehicle against vandalism, damage

from non-accidents, and theft.

The right amount of car insurance

for you depends on the make and model of your car, how (and where) you

drive, and your unique needs.

Compare Insurance Rates by Your Location

Your location can also impact your rates, as theft, vandalism, and accident frequency can vary by geographic region.

| State | Average Annual Premium |

|---|---|

| Alabama | $1,740 |

| Alaska | NA |

| Arizona | $1,705 |

| Arkansas | $1,747 |

| California | $1,987 |

| Colorado | $1,893 |

| Connecticut | $2,150 |

| Delaware | $2,468 |

| District of Columbia | $1,938 |

| Florida | $2,383 |

| Georgia | $2,474 |

| Hawaii | $615 |

| Idaho | $1,070 |

| Illinois | $1,404 |

| Indiana | $1,439 |

| Iowa | $1,385 |

| Kansas | $1,638 |

| Kentucky | $1,963 |

| Louisiana | $2,588 |

| Maine | $1,088 |

| Maryland | $2,426 |

| Massachusetts | $1,804 |

| Michigan | $2,461 |

| Minnesota | $1,465 |

| Mississippi | $1,903 |

| Missouri | $1,784 |

| Montana | $1,584 |

| Nebraska | $1,505 |

| Nevada | $2,112 |

| New Hampshire | $1,222 |

| New Jersey | $2,365 |

| New Mexico | $1,537 |

| New York | $2,535 |

| North Carolina | $1,471 |

| North Dakota | $1,679 |

| Ohio | $1,348 |

| Oklahoma | $1,570 |

| Oregon | $1,616 |

| Pennsylvania | $1,698 |

| Rhode Island | $2,419 |

| South Carolina | $2,103 |

| South Dakota | $1,434 |

| Tennessee | $1,582 |

| Texas | $2,076 |

| Utah | $1,641 |

| Vermont | $1,279 |

| Virginia | $1,589 |

| Washington | $1,863 |

| West Virginia | $1,772 |

| Wisconsin | $1,312 |

| Wyoming | $1,400 |

Auto Insurance Costs by Vehicle Type

Luxury cars can be more expensive to repair and replace, and they tend to cost more to insure than a run-of-the-mill vehicle. Additionally, you may receive a discount for having a car with built-in safety features or anti-theft devices.

Car Insurance Comparison by Credit Score

In most states, having a poor credit history can lead to higher home and auto insurance rates.

While

each of these factors can play a role in determining your premiums,

insurance providers may place a different amount of importance on each

factor. That’s one reason your rates can vary from one company to

another, even when you’re purchasing the same amount of coverage.

3 Ways to Lower Your Car Insurance Rates

Here are three ways you might be able to lower your rate:

Your rates can also change over time, and making a habit of looking for quotes once or twice a year can also help you save.

Comments

Post a Comment